Travel Insurance – Do YOU really need it?

Whenever I think ‘Travel Insurance’ – Do YOU really need it?’ The definitive answer for us, is YES!

For us, this isn’t even a question we consider as we never leave home without it. Sure, it can be expensive, it can also be a bit of an inconvenience. Though, it is well worth any inconvenience or expense, to gain some peace of mind.

If you are thinking ‘I’m on a tight budget’ or ‘nothing will happen to me’ which it may not. Ask yourself, do you cover your personal items, car & house with insurance, when you’re not travelling? If so, is that just in case something ‘may’ happen to your personal property, when you are home, at work or just down the road?

So, the question isn’t really Travel Insurance ‘do I really need it‘? But ‘can I afford not to, have it‘. For us travel insurance is an investment, a way of protecting ourselves & our property whilst we are away. Having travel insurance is a big relief, alleviating many of those ‘what if’ travel anxieties.

In the current global travel climate, changes can happen in a matter of hours. That is why, insurance is a much-needed requirement, for us. Our Travel Planning System provides a section where travel insurance providers can be compared. Giving you confidence that you have the best value for money, for your specific inclusions & budget. We have included below, a comparison of the ‘top plans’ for three providers we regularly use.

Tip: Always review policies with local insurers before planning to travel.

Preview – Travel Insurance – Do I really need it?

In this preview, we briefly outline & addresses the importance of travel insurance. It is definitely something to consider when planning and budgeting for your next trip.

- Top 5 Insurance Claims – ind out what people generally claim.

- When should you purchase Travel Insurance? – making the first defining decision for your upcoming travel plans.

- Which type Travel policy is best for you? – should you get a multi-trip or single policy?

- Travel Insurance terms & Conditions – if you only every read the terms & conditions of one policy in your life, make it this one.

Top 5 Insurance Claims?

Do you ever wonder what people generally claim?

The five most common travel insurance claims include (in no specific order); lost or stolen luggage, money, cards, medical & cancellation or delays to flights. This interactive map looks at common insurance claims by country, including approximate cost of a claim. Once again medical, cancellations, travel delays & baggage, are indicated as the most common reasons for claims.

Some of the most bizzare claims include:

- Surfers who had their hotel room trashed… by monkeys.

- A bird watcher whose camera was knocked into the sea… by a bird.

- An over-packer who claimed for luggage… when she had left it outside upon returning home.

When should you purchase Travel Insurance?

We recommend you don’t leave purchasing your travel insurance until the last minute. The safest time to make your purchase is when you start booking any of your travel inclusions. As certain things not covered if you buy insurance later & have to cancel. This ensures all your large price tag items are covered. As an example flights, accommodation, tours, activities, or a cruise bookings. You could find yourself severely out of pocket if you are required to cancel & find you aren’t covered.

In some instances, travel insurance is included in credit card policies. We strongly recommend, thoroughly checking the terms of any policy you have. To make sure the policy & terms aligns with any & all independent travel insurance policies available.

Which type of policy is best for you?

For those planning that once in a lifetime trip or an annual holiday, a single travel policy is good start for you. Although, if you plan to travel frequently throughout the year, consider a multi-trip or annual policy. These have major benefits including saving of money & time. Additionally, these may be considerably cheaper than several separate single policies. Furthermore you are able to travel throughout the year with confidence, knowing you are covered.

When travelling for more than a year, we recommend contacting your provider to discuss your policy. Confirming which policy is best for YOU & that it can be extended or renewed whilst travelling.

If travelling with expensive items such as phones, cameras, drones or personal jewellery. Ensure your providers limits cover or are close to replacement cost. If not you can contact your provider & asking about option to increase the amounts cover for those items. Another cost saving feature can be excess, increasing your excess, in many cases can reduce your total cost.

Tip: Choose the an excess amount that is comfortable for you during your travels, we generally look between $150 to $250.

We recommend one of three companies when travelling depending on your needs Covermore for travelling around Australia. When travelling overseas, we recommend World Nomads or Safetywing these companies have comprehensive inclusions & very competitive rates. They also offer health insurance whilst out of your country, if this is a desirable option for you.

Travel Insurance Policy Terms & Conditions

If you only every read the terms & conditions of one policy in your life, make it this one.

Talk to your provider about any underlying health issues & check they are covered. Furthermore, ensure all the important things are covered, for what is reasonable to replace whilst away. Check the conditions for making a claim, are there any limitations or general exclusions for when you are covered. Claims, arising due to drinking too much alcohol or driving without an international license for example may not be covered.

Pandemic & Insurance

When purchasing any insurance, check your providers policy on what the pay-outs are in the instance of a pandemic being declared. With the current global situation, we strongly recommend you are covered for the optimum costs due to cancellation. If the policy is unclear, contact your intended provider & discuss whether they provide full or only partial cover.

So, ask yourself not ‘Do I really need travel insurance?’ But ‘Can I rebook my travel plans, or replace my phone, camera, money or luggage?’ if lost, broken or stolen.

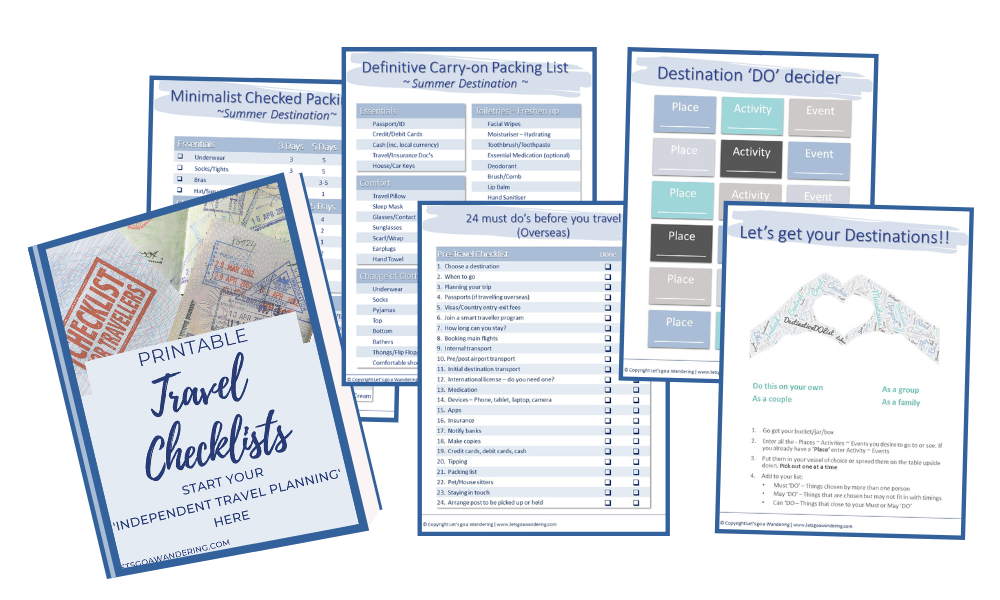

Our travel checklists, are the first step to start your independent travelling. Start building your own Destination ‘DO’ List, or prioritise the one you have.

These make a great inclusion as a great way to gift fun travel experiences.

Checklists for:

- Your destination DO List

- before you travel

- see and do notes

- carry on packing list – warm and cold climate

- checked in packing list – warm and cold climate

I am always happy to reply to any comments, suggestions for next articles or a hello. You can contact me through our Social Media or at jeanine@letsgoawandering.com with any questions or comments.

Other Articles That May You:

Plan your next adventure – Don’t give up your Daydream

24 Last Minute Gifts for Travellers

9 Creative Ways to Gift Fun Travel Experiences

Our Favourite Travel Planning Resources

From Bucket List to Destination DO List

11 Best benefits of small group tours – and why we love them

11 Easy Ways for Traveling more Sustainably

23 Great Sustainable Travel Essentials – it’s the little things

Travel insurance – Do YOU really need it?

The Points or Pay system when travelling??

6 steps to Create YOUR Perfect itinerary

9 Tips for YOUR Perfect Travel Plan and Budget

7 Essentials to Pack for Cold Climate Destinations

6 Luxury Accommodation Styles Pros and Cons

10 Essential International Travel Checklist Points – All you need to know

I never purchase travel insurance, but this article certainly put things into perspective for me. Thanks for sharing your tips and knowledge!

Thank you and glad it helps…it really is a personal choice

This is extremely helpful. Highly recommend traveling with travel insurance. The risk is too great.

Thank you glad it helped…and I couldn’t agree more it is so recommended and an investment not a cost

Having a travel insurance is pretty important in my opinion. I love how realistic you are in this post. Thank you so much for sharing this great resource for travel lovers.

Thank you and Insurance to us is as I say an investment and very important especially in the current travel climate…

Travelling without an insurance can become so much expensive. I have had an accident while camping in Australia and I had to pay more than 2000 AUD. My insurance covered all my expenses and in the end I saved a lot of money. Many travel health care insurances cost only 1 euro per day, so there is really no excuse to not get one.

Thank you Jeanine for this highly valuable article and clarifying that a travel insurance is a must!

I am sorry that you had such an accident but very glad you had insurance, it is so beneficial…and you are welcome as I believe it truly is a must have…

So important to have travel insurance! I use one from my credit card that covers me and my daughter! Love it so much and it is way cheaper that way!

http://Www.LinhyBanh.com

We too used to do that, but the terms and conditions changed and many things weren’t covered the same as buying, which is why we now go through dedicated insurers

Very informative.

I have always made it a point, though, to travel without high-tech, high-priced gear, and use air travel very sparingly (to lessen costs, to lessen my carbon footprint).

(If one is a US citizen / resident, though, I would double-check World Nomads policies. If I remember rightly, they do not cover a US citizen while in the US — and they allow only a limited span of time for being insured, which makes it less useful for long-time traveling.)

Being in Australia our main expense is getting there so I like to cover that…I will have to double check about US citizens in the US thank you…We use Safety Wing for extended travelling…

Traveling is so much less stressful when we know that the expenses will be reimbursed if there’s an unexpected incident. As a parent, I nearly always get travel insurance when we travel. We also insure our expensive devices because with kids, anything can and DOES happen – like losing a phone in a snowdrift… ask me how I know…😆

Oh I hear you and losing phones in snow seems to be mandatory in our family even when they are 20+…I just like to not have to worry if (or when) something happens so agree with you here

Our banking plan covers travel insurance for us, and it’s something we kept even through limited travel in the past couple of years. I would never travel without a proper one in place. Too risky!

I used to use ours as well but they changed the terms so now we purchase it.. but if you have a good plan with the bank or credit card even better…

I agree 100%

Insurance is one of those things that you hope you never have to use but that you’re so happy you got it when you need it.

Travelling without it is too risky!

Definitely so many non injury related things can happen also that just make you glad you have it…

Very informative

Thanks I tried to make it so…

I’ve always wondered if it was worth it, and you’ve definitely convinced me with this post, its always better to be safe 🙂

I agree it is and I always think ‘is it cheaper than replacing a xxxx’ it usually is…

I always wondered about this! It sounds like it is really useful to have, so I will definitely try to make sure I get it any time we travel!

We find it very useful, especially when travelling a great distance from home which is pretty much everywhere…

I was planning to get myself insured before the end of the year. This article really helped convince me to stick to that plan. Thank you so much for sharing x

You are very welcome and glad the article helped, we never leave home without insurance especially in the current travel climate.

We always buy insurance. But in our house the coverage plan is debatable. I always purchase the highest level and add on some extras. But my husband isn’t sure that’s necessary. I also purchase as soon as any money is put down. I just did this for an upcoming trip. It makes me feel better :). I need to check into the companies you recommend. We have always used the same company, which you didn’t list.

We always used a local company but our last trip I wanted health added ‘just in case’ and went with Safety wing and will again for our next OS trip but that is looking to be a long one so definitely worth it for us.

Such great advice. We always think bad stuff will never happen to us, but sometimes it does.

We have been so lucky when we have been travelling (crossing fingers & tapping wood here), but we always get the cover, for the ‘just in case’…because bad stuff can happen…

I totally agree we really do need travel Insurance. My husband was in a car crash and he had 27 fractures of the skull. Eventually had to have an air ambulance flight back to the UK on a leer jet. It cost 27,000 pounds. We would have had to remortgage our house to pay for it. Luckily it was covered on our annual travel insurance.

Wow Lisa, I am so sorry glad the insurance covered it and hope he is better now…thank goodness for Travel Insurance…

OMG yes you need it! I’m from the UK so we don’t pay medical costs – but I’ve seen way too many people caught out going overseas and then something awful happening. I used to spend a month skiing in Canada every winter and you’d be astounded at the number of people who break their leg on Day 2 – and of course it’s not just medical bills, but you want a flight home with extra leg-room etc., etc.

I also knew a woman whose brother crashed the rental car driving out of the airport. It cost a LOT of money to have his body repatriated 🙁 – but he’d taken out insurance for the first time ever.

Insurance is one of those things you don’t EVER want to have to use – but my G-d do you want it there when you do!

I totally agree…it’s our travel ‘peace of mind’ investment… even more so now with the global travel climate…so many people don’t get it